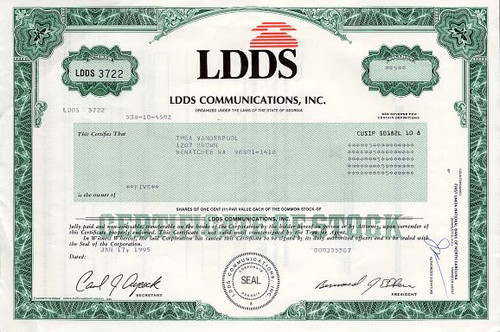

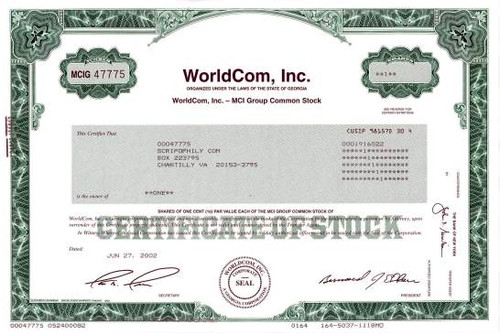

Beautiful SCARCE uncancelled certificate from LDDS Communications, Inc. issued in 1995. This historic document was printed by the Security - Columbian Company and has an ornate border around it with a vignette of the company name and logo. This item has the printed signatures of the Company's President, Bernard J. Ebbers and Secretary, Carl J. Aycock and is over 26 years old.

Certificate Vignette

Certificate Signature

Long Distance Discount Services, Inc. (LDDS) began in Hattiesburg, Mississippi in 1983. In 1985 LDDS selected Bernard Ebbers to be its CEO. The company went public in August 22 1991 when it merged with Busch Companies Inc. The company name was changed to LDDS WorldCom in 1995, and later just WorldCom. The company's growth under WorldCom was fueled primarily through acquisitions during the 1990s and reached its apex with the acquisition of MCI in 1998. Among the companies that were bought or merged with WorldCom were Advanced Communications Corp. (1992), Metromedia Communication Corp.(1993), Resurgens Communications Group(1993), IDB Communications Group, Inc (1994), Williams Technology Group, Inc. (1995), and MFS Communications Company (1996). The acquisition of MFS included UUNet Technologies, Inc., which had been acquired by MFS shortly before the merger with WorldCom. In February 1998, a complex transaction saw WorldCom purchase online pioneer CompuServe from its parent company H&R Block. WorldCom then retained the CompuServe Network Services Division, sold its online service to America Online, and received AOL's network division, ANS. The acquisition of Digex (DIGX) in June 2001 was also complex; Worldcom acquired Digex's corporate parent, Intermedia Communications, and then sold all of Intermedia's non-Digex assets to Allegiance Telecom. On November 10, 1997, WorldCom and MCI Communications announced their US$37 billion merger to form MCI WorldCom, making it the largest merger in US history. On September 15, 1998 the new company, MCI WorldCom, opened for business. On October 5, 1999 Sprint Corporation and MCI WorldCom announced a $129 billion merger agreement between the two companies. Had the deal been completed, it would have been the largest corporate merger in history, ultimately putting WorldCom ahead of AT&T as the largest communications company in the United States. However the deal did not go through because of pressure from the US Department of Justice and the EU on concerns of it creating a monopoly. On July 13, 2000, the Board of Directors of both companies acted to terminate the merger. Later, in 2000, MCI WorldCom renamed itself 'WorldCom' without Sprint being part of the company. Accounting scandals Bernard Ebbers became very wealthy from the rising price of his holdings in WorldCom's stock. However, shortly after the MCI acquisition in 1998, the telecommunications industry entered a downturn and WorldCom's growth strategy suffered a serious blow when it was forced to abandon its proposed merger with Sprint in late 2000. By that time, WorldCom's stock was declining and Ebbers came under increasing pressure from banks to cover margin calls on his WorldCom stock that was used to finance his other businesses (timber and yachting, among others). During 2001, Ebbers persuaded WorldCom's board of directors to provide him corporate loans and guarantees in excess of $400 million to cover his margin calls. The board hoped that the loans would avert the need for Ebbers to sell substantial amounts of his WorldCom stock, as his doing so would put further downward pressure in the stock's price. However, this strategy ultimately failed and Ebbers was ousted as CEO in April 2002 and replaced by John Sidgmore, former CEO of UUNet Technologies, Inc. Beginning in 1999 and continuing through May 2002, the company (under the direction of Ebbers, Scott Sullivan (CFO), David Myers (Controller) and Buford "Buddy" Yates (Director of General Accounting)) used fraudulent accounting methods to mask its declining earnings by painting a false picture of financial growth and profitability to prop up the price of WorldCom's stock The fraud was accomplished primarily in two ways: Underreporting 'line costs' (interconnection expenses with other telecommunication companies) by capitalizing these costs on the balance sheet rather than properly expensing them. Inflating revenues with bogus accounting entries from 'corporate unallocated revenue accounts'. In 2002 a small team of internal auditors at WorldCom worked together, often at night and in secret, to investigate and unearth $3.8 billion in fraud.[2][3][4] Shortly thereafter, the company's audit committee and board of directors were notified of the fraud and acted swiftly: Sullivan was fired, Myers resigned, Arthur Andersen withdrew its audit opinion for 2001, and the U.S. Securities and Exchange Commission (SEC) launched an investigation into these matters on June 26, 2002 (see accounting scandals). By the end of 2003, it was estimated that the company's total assets had been inflated by around $11 billion. Bankruptcy On July 21, 2002, WorldCom filed for Chapter 11 bankruptcy protection in the largest such filing in United States history at the time (since overtaken by the collapse of Lehman Brothers in September 2008). The WorldCom bankruptcy proceedings were held before U.S. Federal Bankruptcy Judge Arthur J. Gonzalez who simultaneously heard the Enron bankruptcy proceedings which were the second largest bankruptcy case resulting from one of the largest corporate fraud scandals. None of the criminal proceedings against WorldCom and its officers and agents were originated by referral from Gonzalez or Department of Justice lawyers. WorldCom changed its name to MCI, and moved the corporate headquarters from Clinton, Mississippi to Dulles, Virginia, on April 14, 2003. Under the bankruptcy reorganization agreement, the company paid $750 million to the SEC in cash and stock in the new MCI, which was intended to be paid to wronged investors. In May 2003, the company was given a no-bid contract by the United States Department of Defense to build a cellular telephone network in Iraq. The deal has been criticized by competitors and others who cite the company's lack of experience in the area. The company emerged from Chapter 11 bankruptcy in 2004 with about $5.7 billion in debt and $6 billion in cash. About half of the cash was intended to pay various claims and settlements. Previous bondholders ended up being paid 35.7 cents on the dollar, in bonds and stock in the new MCI company. The previous stockholders' stock was valueless. It has yet to pay many of its creditors, who have waited for two years for a portion of the money owed. Many of the small creditors include former employees, primarily those who were laid off in June 2002 and whose severance and benefits were withheld when WCOM filed for bankruptcy. On August 7, 2002, the exWorldCom 5100 group was launched. It was composed of former WorldCom employees with a common goal of seeking full payment of severance pay and benefits based on the WorldCom Severance Plan. The '5100' stands for the number of WorldCom employees laid off on June 28, 2002 before WorldCom filed for bankruptcy.[5] On February 14, 2005, Verizon Communications agreed to acquire MCI for $7.6 billion. On March 15, 2005 Bernard Ebbers was found guilty of all charges and convicted of fraud, conspiracy and filing false documents with regulators -- all related to the $11 billion accounting scandal at the telecommunications company he founded. He was sentenced to 25 years in prison. Other former WorldCom officials charged with criminal penalties in relation to the company's financial misstatements include former CFO Scott Sullivan (entered a guilty plea on March 2, 2004 to one count each of securities fraud, conspiracy to commit securities fraud, and filing false statements[6]), former controller David Myers (pleaded guilty to securities fraud, conspiracy to commit securities fraud, and filing false statements on September 27, 2002 [7]), former accounting director Buford Yates (pleaded guilty to conspiracy and fraud charges on October 7, 2002), and former accounting managers Betty Vinson and Troy Normand (both pleading guilty to conspiracy and securities fraud on October 10, 2002). On July 13, 2005 Bernard Ebbers received a sentence that would keep him in prison for 25 years. At time of sentencing, Ebbers was 63 years old. On September 26, 2006, Ebbers self-surrendered to the Bureau of Prisons facility at Oakdale, Louisiana, the Oakdale Federal Corrections Institution ("Oakdale FCI") to begin serving his sentence. This prison facility is 35 miles south of Alexandria, LA, and 58 miles north of Lake Charles, LA. His projected release date is July 4, 2028. In March 2005, 16 of WorldCom's 17 former underwriters reached settlements with the investors. Citigroup settled for $2.65 billion on May 10, 2004. In December 2005, Microsoft announced that MCI will join them by providing Windows Live Messenger customers VOIP service to make calls around the world. This was MCI's last totally new product called "MCI Web Calling". After the merge, this product was renamed "Verizon Web Calling". History from Wikipedia and OldCompany.com (old stock certificate research service).