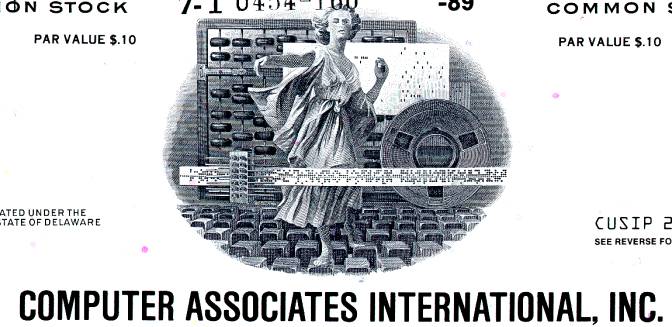

Beautifully engraved specimen certificate from the Computer Associates International, Inc. printed in 1989. This historic document was printed by the American Banknote Company and has an ornate border around it with a vignette of an allegorical woman in front of an abacus. This item has the printed signatures of the Company's President, Anthony Wang and Secretary, and is over 27 years old.

Certificate Vignette Statistics: Public Company Incorporated: 1976 Employees: 17,000 Sales: $4.19 billion (2001) Stock Exchanges: New York Ticker Symbol: CA NAIC: 511210 Software Publishers Company Perspectives: Computer Associates International, Inc. is a leading eBusiness software company. CA's world-class solutions address all aspects of eBusiness Process Management, Information Management, and Infrastructure Management in six focus areas: Enterprise Management, Security, Storage, eBusiness Transformation and Integration, Portal and Knowledge Management, and Predictive Analysis and Visualization. Founded in 1976, CA serves organizations in more than 100 countries, including 99% of Fortune 500 companies. Key Dates: 1976: Charles Wang and partners start CA International as a joint venture with the Swiss firm Computer Associates (CA). 1980: Wang and partners buy the Swiss parent company. 1981: The firm goes public. 1987: CA International acquires rival Uccel for $830 million. 1995: CA International acquires Virginia-based competitor Legent for $1.78 billion. 2000: Founder Wang resigns as CEO. Company History: Computer Associates International, Inc. (CA) is one of the largest computer software vendors in the world. The company sells over 1,200 different products, most of which are designed for businesses rather than home computer users. Because the majority of its products are behind-the-scenes workhorses designed to help big computer networks function, CA's specialty is often called "plumbing" in the software industry. Approximately half of the company's revenue derives from products associated with mainframe computers. CA is the market leader in designing software for managing corporate networks. The company also has a large share of the market for data security and data storage. Other products manage data for wireless networks and run Internet applications. Over 95 percent of Fortune 500 companies use CA software. The company grew enormously through acquisitions, buying up some 60 companies in its first 20 years. Founder Charles Wang gave up the chief executive position in 2000, but remains chairman of the board. Software's Potential in the 1970s Computer Associates was founded in 1976 by Charles Wang. Born in Shanghai, Wang moved with his family to the United States in 1952 when he was eight years old. His father had been educated at Harvard and was a supreme court justice in Shanghai, but had to start over in the United States. The family settled in Queens in New York City, and the elder Wang eventually became a law professor. Two of the sons also studied law, while Charles studied math and physics at Queens College. After his graduation in 1967, Wang took a job as a trainee computer programmer. Though he had little background in the field, Wang took an instant liking to programming. At this time, large, expensive mainframes were the most important computers, and the software industry barely existed. IBM, which sold most mainframes, included basic software in their price, and all customized programming was done in-house. In 1969, the U.S. government began requiring that software be sold separately, allowing individual entrepreneurs to offer competition. After his first trainee job, Wang worked for a small computer service bureau in New York City that marketed software for the Swiss company Computer Associates (CA). When CA decided to establish its own business in the United States, Wang saw an opportunity and in 1976 began Computer Associates International as a joint venture with the Swiss company. With only two partners and a tiny Manhattan office, Wang limited himself to marketing software by telephone. The company was at first funded only by Wang's various credit cards. After an initial failure, he succeeded with CA-SORT, a program enabling computers to sort through data quickly and economically. Wang's SORT offered competition to a similar IBM program, and Wang convinced many businesses with IBM hardware to change over to CA's product. Mainframe software was licensed rather than sold, and the recurring revenue from the licenses of the SORT software was a great boost to Computer Associates. Computer Associates began expanding, hiring salespeople and programmers, and in 1978 Wang's brother Tony, a lawyer, joined the firm. Sales of SORT generated enough money for Wang to buy new programs from smaller firms and market them to customers who already owned SORT. Wang's success allowed him to buy out the original Swiss company in 1980. The company went public in 1981. Expansion Through Acquisitions in the 1980s Computer Associates grew rapidly through acquisitions, buying Capex in 1982 for $22 million in a stock swap. Capex, which was half of CA's size, sold support software for programmers. In 1983, Wang purchased Stewart P. Orr Associates for $2 million and Information Unlimited Software for $10 million. He continued two years later, acquiring Sorcim for $27 million, Johnson Systems for $16 million, and Arkay Computer for an undisclosed amount. With these purchases, Computer Associates became the top independent vendor of system utilities, with a continuing specialization in data compression. In 1985, CA paid CGA Computer $25 million for Top Secret, a computer-security program. Although critics maintained that Wang had paid too much for the program, which had sales of $10 million a year, Wang saw great potential in the product, and sold $36 million worth of Top Secret in the first year after the acquisition. His purchases also brought some software for personal computers, which was the fastest-growing segment of the computer market. CA's main focus at this time was on products designed to improve the performance of IBM equipment. Each time IBM upgraded its computers, it kept portions of old designs so customers could continue to run their older programs; as a result, IBM mainframes were powerful but inefficient. This market presented a particular opportunity for CA because IBM did not make an effort to market products that pointed out defects in its computers; therefore Computer Associates did not have to compete against IBM's larger resources. The firm also continued to attempt to break into applications software, which was earning firms like Microsoft Corporation and Lotus Development Corporation huge sums of money in the personal computer market. It made an important move into applications in 1986 with the $67 million purchase of Integrated System Software Corp., which specialized in graphics software. It also purchased Software International, a maker of financial applications, for $24 million. Despite this new applications strength, system utilities still accounted for 70 percent of Computer Associates' revenues in 1986. In 1987, Computer Associates made its largest purchase yet, acquiring rival Uccel for about $830 million in stock. Uccel had been a competitor in the market for systems utilities software, so the purchase strengthened Computer Associates' already strong systems utilities sector, adding 7,500 customers to CA's base of 26,000 while eliminating a rival company. The purchase temporarily made CA the largest independent software company, ahead of Microsoft, whose strengths lay in software for personal computers. CA also had far more products, marketing about 200 kinds of software to Microsoft's 26 and Lotus's 15. Uccel software filled in several gaps in CA's systems utility product line, but excessive product overlap required a growth strategy involving relentless cost-cutting to maximize profits. CA dismissed 25 percent of Uccel's staff of 1,200 within five days of receiving approval for the deal from the Justice Department. Although some analysts criticized CA throughout its history for focusing on acquisitions at the expense of developing its own programs, Wang's continued pursuit of market share through acquisitions increased his firm's sales from $450 million in 1986 to $628.8 million in 1987. Most of the 13 percent of sales it spent on research and development went to improving its newly acquired software. By 1988, Computer Associates employed 4,500 people in 22 countries and reported $842.1 million in sales. To service its 30,000 customers, which included most Fortune 500 companies, CA had a worldwide sales force of 1,200, with an additional 1,400 in sales support. This high salesperson-to-customer ratio allowed salespeople to concentrate on a few clients; nevertheless, the company received poor ratings for customer satisfaction. Customers brought in by the acquisitions complained of difficulty in finding the right person at CA to answer questions and of CA representatives who appeared to be more interested in making sales than providing support. CA's acquisitions had brought it financial strength and a broad range of software. Its SuperCalc spreadsheet application, bought in 1984, led the company into competition with Lotus and its 1-2-3 spreadsheet, which had become the best-selling software in the personal computer market. Easywriter, a word-processing program bought in 1983, also brought CA strength in the personal computer market. Due to rapid technical advances that made them increasingly powerful, sales of smaller computers grew more quickly than those of mainframes, an aid to Computer Associates. The firm's utilities helped customers squeeze more efficiency from their existing mainframes, and system software such as utilities still accounted for about 75 percent of company revenue. Hoping to lessen its dependency on systems software, CA announced that it would expand applications software to about one-third of its business. Computer Associates acquired another maker of database management software in late 1988, buying Applied Data Research, Inc. for $170 million from Ameritech. CA temporarily ceased its acquisitions in 1989 following the purchase of Cullinet Software Inc. for $289 million. Cullinet sold database management systems, and CA hoped to use the firm's products to help its applications run on IBM, Digital Equipment, and Unix systems. But some of Cullinet's software competed with software Computer Associates already offered, forcing some customers to delay purchasing decisions until CA made it clear which software it would be continuing to offer. Soon after the purchase, CA terminated about 900 Cullinet positions. The absorption of Cullinet, along with need for internal streamlining (the assignments of CA's 600 U.S. salespeople had begun to overlap, with up to four representatives servicing one account), necessitated a corporate reorganization. Simultaneously, mainframe and minicomputer sales slacked off, hurting the market for programs. With the acquisition of Uccel and Cullinet, Computer Associates became the first software firm to top $1 billion in sales, in 1989. As a result of its mounting problems, however, CA's growth dropped from 45 percent in 1989 to 6 percent in 1990, and its stock price dropped 50 percent. Computer Associates was again sharply criticized for a lack of focus after the Cullinet deal. CA responded by unveiling Computing Architecture 1990s in April 1990, a software strategy intended to bring some order to the group of software products it had acquired during the past decade. The plan had three major components: database management, systems management, and applications. The firm vowed to make all of its programs work together and "talk" to each other across different types of computer hardware and operating systems. This type of networking was increasingly important in the computer industry, with networks of smaller computers displacing mainframes. The Computing Architecture 1990s system, which used software intermediaries to connect different types of computer systems, applying them like telephone switches, was made possible in part by CA Datacom/DB, a widely installed database management system the firm acquired with Applied Data Research in 1988. To help the plan along, Computer Associates spent $190 million on research and development in 1990. In combination with the Computing Architecture 1990s plan, Wang spent 1990 refocusing his 7,000 employees on product development and customer service. Programmers worked overtime to update older programs and boost customer confidence. Supercalc 5, released in 1990, included graphics and database management, making it competitive with Lotus 1-2-3 and Microsoft Excel. CA-Cricket Presents was a desktop presentation package that sold for half the price of competitors like Aldus Persuasion and Microsoft PowerPoint. CA-Textor, released in 1992, was an entry-level word processor designed to work with Microsoft's Windows graphic interface. Despite numerous programs for personal computers, Computer Associates suffered from anonymity in the personal computer market, with Supercalc attaining only about a 5 percent share of the spreadsheet market. New Products and Markets in the 1990s Computer Associates pushed aggressively into foreign markets, notably Canada and Japan, and overseas sales accounted for 40 to 45 percent of annual revenues. CA became more flexible in pricing its annual maintenance fees for updating and troubleshooting software. These fees comprised 33 percent of revenues, up from 20 percent four years earlier. Despite this increased flexibility, the firm's pricing policies were controversial, angering some because of the tough stand taken on prices when a client changed the way it used CA software. Continuing its push to work with different computer platforms, CA agreed in 1991 to make many of its products work with Hewlett-Packard's Unix-based computers and reached a licensing agreement with Apple Computer to allow its databases to be accessed through Apple's Macintosh computers. It also bought a number of software vendors including Access Technology, whose software worked on Vax systems made by Digital Equipment. Computer Associates acquired On-Line Software International Inc. for about $120 million and Pansophic Systems Inc. for about $290 million, both mainframe software manufacturers. Sales for 1991 came to $1.35 billion. Computer Associates' ambitious restructuring was hindered in a legal dispute with rival Electronic Data Systems Corporation (EDS) beginning in 1991. EDS accused Computer Associates of unfair business practices including monopoly and licensing fraud, breach of contract, and misuse of copyright. In early 1992, CA countersued, accusing EDS of pirating its software and wide-scale fraud. The dispute was not settled until 1996. Bitter feelings toward CA were evidently common among its customers, yet the company had a vast array of extremely useful products, and so the company was hard to avoid. In 1995, the company announced a deal worth $1.78 billion to acquire its competitor Legent Corporation, a Virginia-based software maker. This was at the time the biggest takeover deal ever in the software industry. Legent's strength was in so-called client-server computer software, where instead of a large, powerful mainframe, a network of computers interacted through software stored in a central server computer. CA had made a move toward client-server computing two years earlier, bringing out a new product called CA-Unicenter. CA had also bought another client-server software specialist in 1994, the ASK Group. It also acquired Cheyenne Software Inc. in 1996, a company that specialized in data storage software on network computers. By the mid-1990s, about one-third of CA's sales were in client-server software products. The company's revenue grew to over $3.5 billion in 1996, and earnings and CA's stock price also rose year by year through the first half of the decade. By the late 1990s, the company was still growing, yet it faced new problems. One was that it was more difficult for CA to keep acquiring smaller companies. The Justice Department had put conditions on the company's further takeovers after the huge Legent deal. In addition, CA's stock price tended to yo-yo, fueled in part by Wall Street analysts' concerns that the company bought up firms with mature products and then squeezed money out of them, rather than looking for emerging products from young competitors. Moreover, though CA made a major effort beginning in the mid-1990s to turn around its reputation for poor customer service, a survey in 2001 showed only 10 percent of large customers were satisfied with CA. CA had a 25 percent share of the mainframe computer software market by the late 1990s, only one point behind market leader IBM, yet the mainframe market was expanding only very slowly. The company relaunched its premier client-server software in 1997, Unicenter TNG, hoping for more of the booming network market. Despite growing revenue, CA continued to hit bumps in the late 1990s and into the new millennium. A slowdown in its European markets and the economic slump in Asia affected company earnings. Charles Wang, second-in-command Sanjay Kumar, and another top executive were given huge bonuses in 1998, for which the company had to take a $675 million charge against earnings to pay. In 2000, a court order required the executives to pay back about half the bonus, some $550 million. CA had made two additional large acquisitions in 1999 and 2000, shelling out for software maker Platinum and then Sterling Software. The company now had a huge amount of debt, almost three times earnings. In August 2000, Charles Wang agreed to step out of the CEO role and not handle the day-to-day business of the company. He remained chairman, and the CEO job went to former President Sanjay Kumar. Kumar vowed to grow the company without more acquisitions, though this seemed difficult to do. He was perhaps more popular than the gruff Wang, and he personally intervened in 2001 when Wal-Mart Stores declared it would stop using CA software. Nevertheless, investors seemed dissatisfied with CA's prospects, and the board faced a proxy battle in the summer of 2001. Management's picks remained on the board, but the company faced further criticism. It had changed its accounting method in October 2000 in order to even out profit and revenue from long-term contracts. The company ended up with two sets of numbers, which was confusing, and in 2002 the Securities and Exchange Commission was prompted to investigate CA's bookkeeping. CA planned a $1 billion bond offering in February 2002 that would have refinanced some of the company's $3.5 billion debt to a more favorable rate. But the day before the bond offering, the investor's service Moody's declared it was considering downgrading CA's debt rating, citing a tightening cash flow, and CA canceled the offering. By 2002, the company had over 1,200 software products, and was still the leader in several key markets. Principal Subsidiaries: interBiz; iCanSP; ACCPac; CA Federal; MultiGen-Paradigm. Principal Competitors: International Business Machines Corporation; Microsoft Corporation; BMC Software Inc. History from Wikipedia and OldCompany.com (old stock certificate research service)

About Specimen Certificates Specimen Certificates are actual certificates that have never been issued. They were usually kept by the printers in their permanent archives as their only example of a particular certificate. Sometimes you will see a hand stamp on the certificate that says "Do not remove from file". Specimens were also used to show prospective clients different types of certificate designs that were available. Specimen certificates are usually much scarcer than issued certificates. In fact, many times they are the only way to get a certificate for a particular company because the issued certificates were redeemed and destroyed. In a few instances, Specimen certificates were made for a company but were never used because a different design was chosen by the company. These certificates are normally stamped "Specimen" or they have small holes spelling the word specimen. Most of the time they don't have a serial number, or they have a serial number of 00000. This is an exciting sector of the hobby that has grown in popularity over the past several years.

Certificate Vignette

About Specimen Certificates Specimen Certificates are actual certificates that have never been issued. They were usually kept by the printers in their permanent archives as their only example of a particular certificate. Sometimes you will see a hand stamp on the certificate that says "Do not remove from file". Specimens were also used to show prospective clients different types of certificate designs that were available. Specimen certificates are usually much scarcer than issued certificates. In fact, many times they are the only way to get a certificate for a particular company because the issued certificates were redeemed and destroyed. In a few instances, Specimen certificates were made for a company but were never used because a different design was chosen by the company. These certificates are normally stamped "Specimen" or they have small holes spelling the word specimen. Most of the time they don't have a serial number, or they have a serial number of 00000. This is an exciting sector of the hobby that has grown in popularity over the past several years.