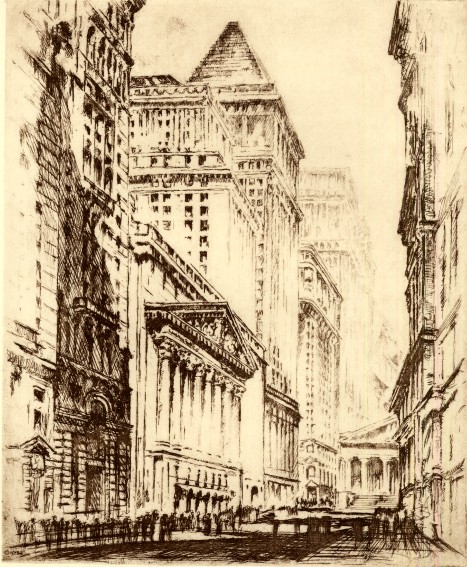

Beautiful unissued authentic membership certificate from the New York Stock Exchange. This historic document is a Intaglio printed on heavy paper and has an sepiatone image of the New York Stock Exchange and measures 14" x 20". The wording on the bottom is printed in raised print. This item came from the archives of the New York Printer, Andersen Lamb. The border around the image and wording is raised. This historic item would look terrific framed.

New York Stock Exchange

Membership Wording The New York Stock Exchange (NYSE), nicknamed the "Big Board", is a New York City-based stock exchange. It is the largest stock exchange in the world by dollar volume and the second largest by number of companies listed. Its share volume was exceeded by that of NASDAQ during the 1990s. The New York Stock Exchange has a global capitalization of $23.0 trillion as of September 30, 2006. The NYSE is operated by NYSE Euronext, which was formed by its merger with the fully electronic stock exchange Archipelago Holdings and Euronext. The New York Stock Exchange trading floor is located at 11 Wall Street, and is composed of five rooms used for the facilitation of trading. The main building, located at 18 Broad Street between the corners of Wall Street and Exchange Place, was designated a National Historic Landmark in 1978.[1] NYSE Group merged with Euronext, and many of its operations (particularly IT and the trading platform) will be combined with that of the New York Stock Exchange and NYSE Arca. The New York Stock Exchanges provides an efficient method for buyers and sellers to trade shares of stock in companies registered for public trading. The exchange provides efficient price discovery via an auction environment designed to produce the fairest price for both parties. Since September 30, 1985 the NYSE trading hours have been 9:3016:00 ET. (As of February 9, 2007, the streetTRACKS Gold Shares ETF started its trading day on the NYSE at 8:20AM.) As of January 24, 2007, all NYSE stocks can be traded via its electronic Hybrid Market (except for a small group of very high priced stocks). Customers can now send orders for immediate electronic execution, or route orders to the floor for trade in the auction market. In excess of 50% of all order flow is now delivered to the floor electronically. On the trading floor, the NYSE trades in a continuous auction format. Here, the human interaction and expert judgment as to order execution differentiates the NYSE from fully electronic markets. There is one specific location on the trading floor where each listed stock trades. Exchange members interested in buying and selling a particular stock on behalf of investors gather around the appropriate post where a specialist broker, who is employed by a NYSE member firm (that is, he/she is not an employee of the New York Stock Exchange), acts as an auctioneer in an open outcry auction market environment to bring buyers and sellers together and to manage the actual auction. They do on occasion (approximately 10% of the time) facilitate the trades by committing their own capital and as a matter of course disseminate information to the crowd that helps to bring buyers and sellers together. The frenzied commotion of men and women in colored smocks has been captured in several movies, including Wall Street. In the mid-1960s, the NYSE Composite Index (NYSE: NYA) was created, with a base value of 50 points equal to the 1965 yearly close, to reflect the value of all stocks trading at the exchange instead of just the 30 stocks included in the Dow Jones Industrial Average. To raise the profile of the composite index, in 2003 the NYSE set its new base value of 5,000 points equal to the 2002 yearly close. (Previously, the index had stood just below 500 points, with lifetime highs and lows of 670 points and 33 points, respectively.) The right to directly trade shares on the exchange is conferred upon owners of the 1366 "seats". The term comes from the fact that up until the 1870s NYSE members sat in chairs to trade; this system was eliminated long ago. In 1868, the number of seats was fixed at 533, and this number was increased several times over the years. In 1953, the exchange stopped at 1366 seats. These seats are a sought-after commodity as they confer the ability to directly trade stock on the NYSE. Seat prices have varied widely over the years, generally falling during recessions and rising during economic expansions. The most expensive seat was sold in 1929 for $625,000, which, adjusted for inflation, is over six million in today's dollars. In recent times, seats have sold for as high as $4 million in the late 1990s and $1 million in 2001. In 2005, seat prices shot up to $3.25 million as the exchange was set to merge with Archipelago and become a for-profit, publicly traded company. Seat owners received $500,000 cash per seat and 77,000 shares of the newly formed corporation. The NYSE now sells one-year licenses to trade directly on the exchange. The origin of the NYSE can be traced to May 17, 1792, when the Buttonwood Agreement was signed by twenty-four stock brokers outside of 68 Wall Street in New York under a buttonwood tree. On March 8, 1817, the organization drafted a constitution and renamed itself the "New York Stock & Exchange Board". This name was shortened to its current form in 1863. Anthony Stockholm was elected the Exchange's first president. The first central location of the NYSE was a room rented for $200 a month in 1817 located at 40 Wall Street. But the volume of stocks traded had increased sixfold in the years between 1896 and 1901 and a larger space was required to conduct business in the expanding marketplace.[2] Eight New York City architects were invited to participate in a design competition for a new building and the Exchange selected the neoclassic design from architect George B. Post. Demolition of the existing building at 10 Broad Street and the adjacent lots started on 10 May 1901. The New York Stock Exchange building opened at 18 Broad Street on April 22, 1903 at a cost of $4 million. The trading floor was one of the largest volumes of space in the city at the time at 109 x 140 feet wide (33 x 42.5 meters) with a skylight set into a 72 foot high ceiling (22 m.) The main façade of the building features marble sculpture by John Quincy Adams Ward in the pediment, above six tall Corinthian capitals, called "Integrity Protecting the Works of Man". The building was listed as a National Historic Landmark and added to the National Register of Historic Places on June 2, 1978.[3] In 1922, a building designed by Trowbridge & Livingston was added at 11 Broad Street for offices, and a new trading floor called "the garage". Additional trading floor space was added in 1969 and 1988 (the "blue room") with the latest technology for information display and communication. Another trading floor was opened at 30 Broad Street in 2000. With the arrival of the Hybrid Market, a greater proportion of trading was executed electronically and the NYSE decided to close the 30 Broad Street trading room in early 2006. Security after 9/11 U.S. Secretary of Commerce Donald L. Evans rings the opening bell at the NYSE on April 23, 2003. Former chairman Richard Grasso is also in this picture. The Exchange was closed shortly after the beginning of World War I (July 1914), but it re-opened on November 28 of that year in order to help the war effort by trading bonds. On September 16, 1920, a bomb exploded on Wall Street outside the NYSE building, killing 33 people and injuring more than 400. The perpetrators were never found. The NYSE building and some buildings nearby, such as the JP Morgan building, still have marks on their facades caused by the bombing. The Black Thursday crash of the Exchange on October 24, 1929, and the sell-off panic which started on Black Tuesday, October 29, are often blamed for precipitating the Great Depression. In an effort to try to restore investor confidence, the Exchange unveiled a fifteen-point program aimed to upgrade protection for the investing public on October 31, 1938. On October 1, 1934, the exchange was registered as a national securities exchange with the U.S. Securities and Exchange Commission, with a president and a thirty-three member board. On February 18, 1971 the not-for-profit corporation was formed, and the number of board members was reduced to twenty-five. Following a 554.26 point drop in the Dow Jones Industrial Average which was a 22.6% loss in a single day, the biggest ever before in a single day (DJIA) on October 19, 1987, officials at the Exchange for the first time invoked the "circuit breaker" rule to stop trading. This was a very controversial move and prompted a quick change in the rule; trading now halts for an hour, two hours, or the rest of the day when the DJIA drops 10, 20, or 30 percent, respectively. In the afternoon, the 10% and 20% drops will halt trading for a shorter period of time, but a 30% drop will always close the exchange for the day. The rationale behind the trading halt was to give investors a chance to cool off and reevaluate their positions. As a matter of fact, Black Monday was followed by Terrible Tuesday, a day in which the systems did not work and people who wanted to buy or sell shares could not conduct their trades at all, for unknown reasons. Further information: Black Monday (1987) There was a panic similar to many with a fall of 7.2% in value on October 27, 1997 prompted by falls in Asian markets, from which the NYSE recovered quickly. Further information: October 27, 1997 mini-crash The NYSE was closed from September 11 until September 17, 2001 as a result of the September 11, 2001 attacks. On September 17, 2003, NYSE chairman and chief executive Richard Grasso stepped down as a result of controversy concerning the size of his deferred compensation package. He was replaced as CEO by John Reed, the former Chairman of Citigroup. On April 21, 2005, the NYSE announced its plans to acquire Archipelago, in a deal that is intended to bring the NYSE public. On December 6, 2005, the NYSE's governing board voted to acquire rival Archipelago and become a for-profit, public company. It began trading under the name NYSE Group on March 8, 2006. On April 4, 2007, the NYSE Group completed its merger with Euronext, forming the NYSE Euronext. Marsh Carter is the Chairman of the New York Stock Exchange, succeeding John S. Reed. John Thain is the CEO of the NYSE. Gerald Putnam and Catherine Kinney are the co-Presidents of the NYSE. New York Stock Exchange 1792 - The NYSE acquires its first traded company 1817 - The constitution of the New York Stock and Exchange Board is drafted 1867 - The First Stock Ticker [1] 1896 - Dow Jones Industrial Average first published in The Wall Street Journal. 1903 - NYSE moves into new quarters at 18 Broad Street 1907 - Panic of 1907 1914 - World War I causes the longest exchange shutdown 1929 - Central quote system established 1929 - Black Thursday (October 24) and Black Tuesday (October 29) 1943 - The trading floor is opened to women [4] 1949 - Longest bull market begins[citation needed] 1954 - The Dow surpasses its 1929 peak 1966 - NYSE creates the Common Stock Index 1966 - Floor data fully automated[citation needed] 1970 - Securities Investor Protection Corporation established 1971 - NYSE Not-for-Profit[citation needed] 1972 - The Dow closes above 1,000 1977 - Foreign brokers are admitted to the NYSE 1979 - New York Futures Exchange established 1987 - Black Monday, October 19: the largest one-day percentage drop of the Dow Jones Industrial Average 1991 - The Dow exceeds 3,000 1996 - Real-time ticker introduced[citation needed] 1999 - The Dow exceeds 10,000 2000 - First global index launched[citation needed] 2001 - Trading in fractions (n/16) ends; replaced by decimals (see Decimalisation) 2001 - September 11, 2001 attacks: NYSE closed for 4 session days 2003 - NYSE Composite Index relaunched 2006 - NYSE and ArcaEx merge, forming the publicly owned, for-profit NYSE Group, Inc. 2006 - NYSE Group merges with Euronext, creating the first trans-Atlantic stock exchange group 2006 - DJIA tops 12,000 on October 19; NYSE Composite tops 9,000 on December 4 2007 - US President George W. Bush shows up unannounced to the Floor about an hour and a half before an FOMC interest-rate decision. The market comes to a complete standstill for approximately 30 minutes. Bush spends a few minutes talking with specialists [5] 2007 - DJIA drops 416 points, its largest point decline since 2001 (after a sharp drop in the Chinese stock market), on February 27 History from Wikipedia and OldCompanyResearch.com.

New York Stock Exchange

Membership Wording

1 Review Hide Reviews Show Reviews

-

Good collectible stockcertificate

God service and product