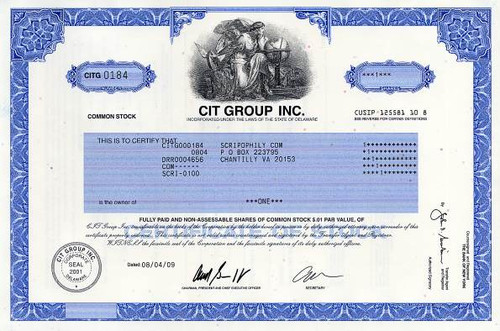

Beautifully engraved certificate from the Peabody Coal Company issued no later than 1967. This historic document was printed by the American Banknote Company and has an ornate border around it with a vignette of the company logo between an allegorical men with caol steam shovel and coal processing plant in the background. This item has the printed signatures of the Company's President and Secretary. The certificate has been cancelled sith a redemption stamp indicating payment of a liquidating distribution. April 13, 2016 - Peabody Energy Files for Chapter 11 Bankruptcy Protection Coal company's filing includes most of U.S. activities, excludes Australian operations In 1953, low-cost, high-volume surface-mined coal had made major inroads in the market, and Peabody Coal Company -- then the nation's eighth-largest coal producer -- was fighting for its life. After heavy losses in 1954, merger talks were initiated with Sinclair Coal Co., the third-largest coal producer in the country. In 1955, the companies merged, and when the deal was struck, the Peabody Coal Company name was retained. Peabody's listing on the New York Stock Exchange provided Sinclair with access to capital for investment and expansion. And for Peabody Coal Company, Sinclair's highly competitive surface mining operations located in six Midwestern states meant survival. Russell Kelce -- one of three brothers who helped lead the new company -- assumed the presidency, energizing it with his vision of modern coal mining. Mines were acquired, new mines were opened, and equipment at existing mines was upgraded. And before any requirement by state or federal laws, Operation Green Earth was launched. This ambitious program was aimed at planting trees and other vegetation and reintroducing fish and wildlife onto mined lands. Almost 50,000 mined acres were returned to productive use in a 10-year period. Although Kelce didn't live to see the results of his foresight, his brothers, Merl and Ted, carried out his vision and enhanced it with their years of practical knowledge. Merl Kelce served as President and CEO beginning in 1957 during a period when the production, sales and reserve base more than doubled. He was named chairman and CEO in 1965. An unprecedented exploration program was set in motion in the Western United States, and Peabody Coal Company opened the first large surface mine in Queensland, Australia, its first venture outside of North America. When Ted, the last of the Kelce brothers to serve as Peabody Coal Company president retired in 1965, Thomas C. Mullins, an executive vice president, was named to succeed him. Three years later, Kennecott Copper Corp. successfully bid for Peabody Coal Company's stock, an event that touched off eight years of antitrust litigation. Mullins' unexpected death in 1971 brought engineering and operations veteran Edwin R. Phelps to the presidential post. After an eight-year court battle, the Federal Trade Commission prevailed, and the court ordered Kennecott to divest itself of Peabody Coal Company in 1976. Peabody Energy (NYSE: BTU) is the world's largest private-sector coal company, with 2002 sales of 198 million tons of coal and $2.7 billion in revenues. Its coal products fuel more than 9 percent of all U.S. electricity generation and more than 2 percent of worldwide electricity generation. History from company press information.

Peabody Coal Company ( Now Peabody Energy ) - Peabody Energy Files for Chapter 11 Bankruptcy Protection

MSRP:

$89.95

$69.95

(You save

$20.00

)

- SKU:

- pecoco

- Gift wrapping:

- Options available