Beautiful engraved Stock Certificate from The AMF Company - previoulsy known as American Machine and Foundry issued no later than 1979. American Machine and Foundry formally changed their name in 1971 to the AMF Company since they were out of the foundry business and concentrating their efforts on bowling equipment. This item has an orange ornate border with a vignette of an allegorical man sitting in front of a factory. AMF's success underscores the dynamic growth that can be achieved by focusing on the development of the world's most popular recreational activity, bowling. Today's AMF is a global manufacturer and marketer of bowling products, and the owner and operator of more than 500 bowling centers in 11 countries. Their mission in their bowling products business is to provide our trade partners and bowling proprietor customers with the highest quality products, to make the experience of their consumers as enjoyable and successful as it can be. Within their own bowling centers, their goal is to build on the popularity of bowling and provide an active, recreational fun experience for friends and family. Bowling is a growth business, both in the United States and worldwide. During the past year alone, they acquired the 50-center Bowling Corporation of America chain and American Recreation Centers, Inc., which operated 43 bowling centers in six states. Internationally, AMF's focus is on emerging markets that hold huge and exciting potential for bowling. With 25 sales offices around the globe, their bowling products business supplies more than 10,000 centers worldwide. They also own and operate 36 centers in Australia, 21 in the United Kingdom, 9 in Mexico, 6 in southern Europe, 6 in Hong Kong/China, and 5 in Japan. Bowling's appeal transcends cultural, language, demographic and geographic boundaries. It's a sport with a rich tradition and even brighter future. As the largest company in the world focused solely on bowling, AMF is excited about the prospect of moving bowling to a new level of recreational and competitive fun throughout the globe. This historic item is a very collectible piece. July 03, 2001 AMF Bowling Worldwide Files Voluntary Chapter 11 Petition To Facilitate Major Financial Restructuring Jump to first matched term $75 Million Debtor-in-Possession Financing Arranged All Bowling Centers and Manufacturing Facilities Open And Conducting Business In the Ordinary Course RICHMOND, Va., July 3 /PRNewswire/ -- AMF Bowling Worldwide and its U.S. subsidiaries today filed for reorganization under Chapter 11 of the U.S. Bankruptcy Code. The filings, in Richmond, Virginia, will enable AMF to maintain ordinary course operations while it finalizes and implements a reorganization plan to significantly reduce its long-term debt and interest expense. AMF announced in April that it would likely take this action in order to facilitate an orderly financial restructuring. The company has reached an agreement in principle with the steering committee of its senior lenders on a new capital structure and the terms of a plan of reorganization. AMF expects to submit this plan and a disclosure statement in early August after the approval of the agreement in principle by the requisite majority of its senior lenders. The plan of reorganization will reduce outstanding debt and provide improved financial flexibility for AMF. Debtor-in-Possession Financing Arranged Members of AMF's current senior lending group have agreed to provide the company with a $75 million debtor-in-possession financing facility, subject to court approval that is expected later today. These funds will be available to supplement the company's operating cash flow for funding business operations, including payment under normal terms to suppliers and vendors for all goods and services that are provided to the company during Chapter 11. AMF Conducting Business in the Ordinary Course Roland Smith, AMF's President and Chief Executive Officer, noted that the court filing is not expected to have any significant impact on AMF's day-to-day operations: "We will continue welcoming customers at our bowling centers, and we will continue to make and sell our bowling products. While the refinancing will be an important step towards a more successful future, our primary focus will continue to be our customers and their satisfaction with our products and services." All 518 of the company's bowling centers around the world remain open and will be conducting normal business operations. League play and all other activities at the bowling centers, such as corporate parties and special promotions, will continue as planned. All three of the company's manufacturing facilities are open and will operate on regular schedules. Proposed Reorganization Plan Under the terms of the plan to which AMF and the steering committee of senior lenders have agreed in principle, the senior lenders will receive a combination of cash, debt and common stock of the reorganized company. Based on a hypothetical reorganization value of $700 million, these distributions will provide payment in full to the senior lenders for their secured claims of approximately $625 million. Unsecured creditors will receive the remainder of the reorganized company's common stock, as well as warrants to purchase additional shares. The reorganized company will implement a management stock option program tied to the company's future performance. AMF Bowling Worldwide will not make a distribution to AMF Bowling, Inc., the parent company. As a result, while AMF Bowling, Inc. has not yet filed for Chapter 11 protection, it is expected that the common stock and the zero coupon convertible debentures of AMF Bowling, Inc. will ultimately be cancelled. The details of AMF Bowling Worldwide's proposed capital structure will be contained in a plan of reorganization and a disclosure statement that the company expects to file with the court in early August. The plan and the disclosure statement are subject to the approval of the creditors and the bankruptcy court. "We have negotiated a plan of reorganization with the bank group steering committee that will position AMF for long-term success," said Smith. "We intend to use this court-supervised process to implement a plan of reorganization that reduces our long-term debt and interest expense and allows us to redirect our operating cash flow toward more productive uses. At the same time, we will continue to implement our strategic business plan, which is focused on improving operations in the future." Strategic Changes Continue at AMF "Over the past year, we have implemented a number of actions to strengthen AMF's business operations and enhance financial performance," said Smith. "While AMF continues to generate positive cash flow from operations, today's court filing is a necessary step in the refinancing process to make AMF a stronger, financially sound company in the years to come." During the past year, AMF has made a number of strategic personnel and organizational changes in both its Centers and Products businesses. These changes included initiatives that streamlined the U.S. Bowling Centers' organization and instituted a new operating model focused on the bowling center manager. In conjunction with this model, the company created new training schools for center and facility managers and also established new performance-based compensation and benefits programs for center managers and staff. John Suddarth, the new Chief Operating Officer for Bowling Products, began implementation of organizational changes in May to reduce costs and improve both product quality and customer service. Upon completion of the operational turnaround currently underway, the company believes that its Products business will be positioned to deliver improved results. Mr. Smith emphasized that AMF remains committed to long-term growth of its business in the U.S. and its global markets: "Bowling is fundamentally a good business. With almost 54 million Americans bowling at least once last year, it is the largest participatory sport in the U.S. Around the world, we estimate that over 100 million people in 90 countries went bowling last year." AMF As the largest bowling company in the world, AMF owns and operates 518 bowling centers worldwide, with 400 centers in the U.S. and 118 centers in ten other countries. AMF is also a world leader in the manufacturing and marketing of bowling products. In addition, the company manufactures and sells the PlayMaster, Highland and Renaissance brands of billiards tables. Additional information about AMF is available on the Internet at http://www.amf.com, as well as on a new toll-free AMF Refinancing Hot Line at 866-743-2625. SOURCE AMF Bowling Worldwide

AMF (Bowling) Company - Pre Bankruptcy

MSRP:

$13.95

Was:

Now:

$9.95

(You save

$4.00

)

- SKU:

- amfcompany

- UPC:

- Gift wrapping:

- Options available in Checkout

Add to Cart

The item has been added

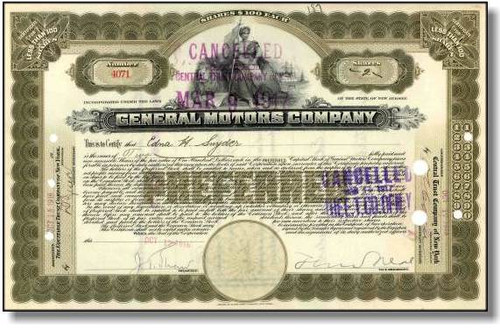

General Motors Company 1916 (Pre Bankruptcy) - New Jersey

MSRP:

$129.95

Was:

Now:

$99.95

Add to Cart

The item has been added

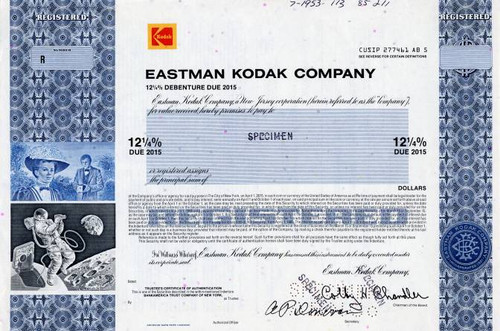

Eastman Kodak Company (Pre Bankruptcy) Specimen - New Jersey 1985

MSRP:

$250.00

Was:

Now:

$195.00

Add to Cart

The item has been added

Eastman Kodak Company (Pre Bankruptcy) Specimen - New Jersey 1990

MSRP:

$129.95

Was:

Now:

$99.95

Add to Cart

The item has been added

Eastman Kodak Company (Pre Bankruptcy) Specimen - New Jersey 1983

MSRP:

$395.00

Was:

Now:

$295.00

Add to Cart

The item has been added

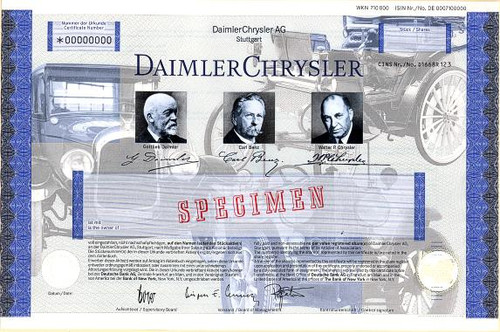

Daimler Chrysler ( Mercedes Benz Car Company ) - Pre Chrysler Sale and Bankruptcy

MSRP:

$129.95

Was:

Now:

$99.95

Add to Cart

The item has been added

Penn Central Company post Bankruptcy

MSRP:

$24.95

Was:

Now:

$14.95

Burlington Industries Incorporated - Pre Bankruptcy

MSRP:

$99.95

Was:

Now:

$79.95

Add to Cart

The item has been added

General Motors Company 1917 (Pre Bankruptcy ) - New Jersey - Early Date + Clean Vignette

MSRP:

$199.95

Was:

Now:

$169.95

Add to Cart

The item has been added

Pan American World Airways - Pre Bankruptcy

MSRP:

$12.95

Was:

Now:

$8.95